Enough Was Enough Years Ago!

Talking About Property Taxes.

It’s like we’re stuck in a never-ending loop of enormus Tax Assessments and City spending madness.

Texas proudly claims there’s no state property tax, but it’s not much consolation when you understand the goals of the current generation of bureaucrats. Spend it now and borrow more. Find an excellent reason to spend more money. Increase spending every year. — Sound familiar? —

This Property Tax mess is a never-ending story. Our local governments are having a field day spending your tax dollars, and trust me, they’re not holding back. Very often Cities are wasting money experimenting with Street Rehabilitation, Event Centers, and Industrial Parks. It’s a constant drain on our wallets, with only “politically promised” state-level tax relief in sight.

So, next time you’re examining your Property Tax Bills, just remember: while there might not be a state property tax, we are definitely not getting off easy. It’s high time we demand a clearer, fairer, more transparent system because we deserve better than this usual Local Tax Circus.

Here is an example:

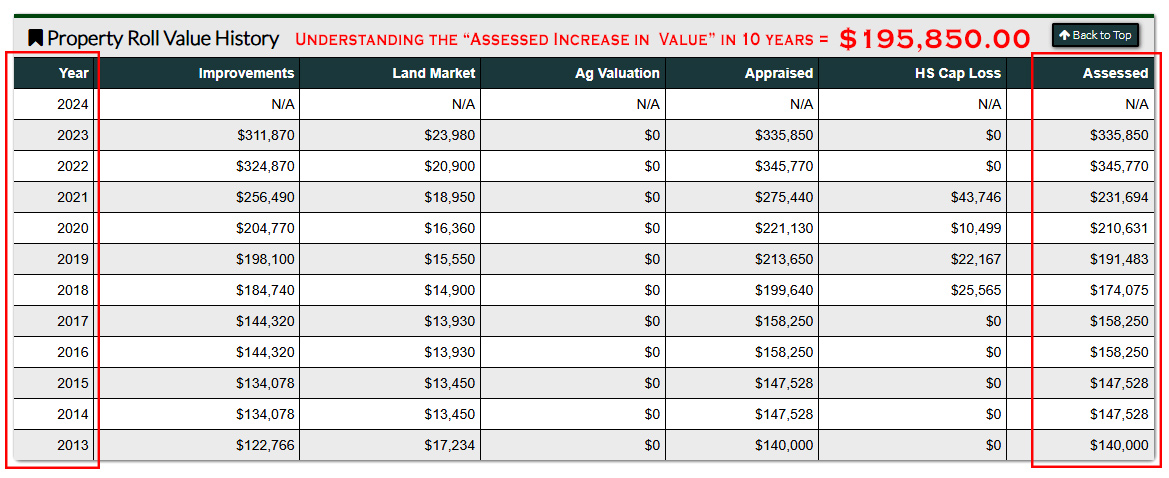

This is an actual “Property Roll Value History” table demonstrating the enormous increases in Property “Assessed Value.” This graphic describes a house that is 60 years old and has increased in Taxable [Assessed] Value by “two hundred thousand dollars.” Often, annually either the “Tax Rate” is increased or the “Appraised Value” and sometimes both are increased. It’s the bureaucratic shell game, [while you are looking here the increase is over there]. The Tax process and the Tax rules are complex such that very few understand what is going on. Often, they just pay the Tax and move on.

The following example “tells the tale.” In ten years, this property [graphic below] in McGregor, Texas has increased in “ASSESSED VALUE” by $200,000.00.

Taxpayers with fixed incomes are being taxed out of their own homes. If this does not motivate you to do something, then nothing will. This is not what individuals in charge of Tax Assessment should be doing in Texas.

If you own property in McLennan County you can find this Tax information online, Navigate To: https://esearch.mclennancad.org — Select the “By Owner” tab [if visible], type in your name, then click on your name in the listing. If you need help navigate to: https://mclennancad.org click on “Contact Us.”

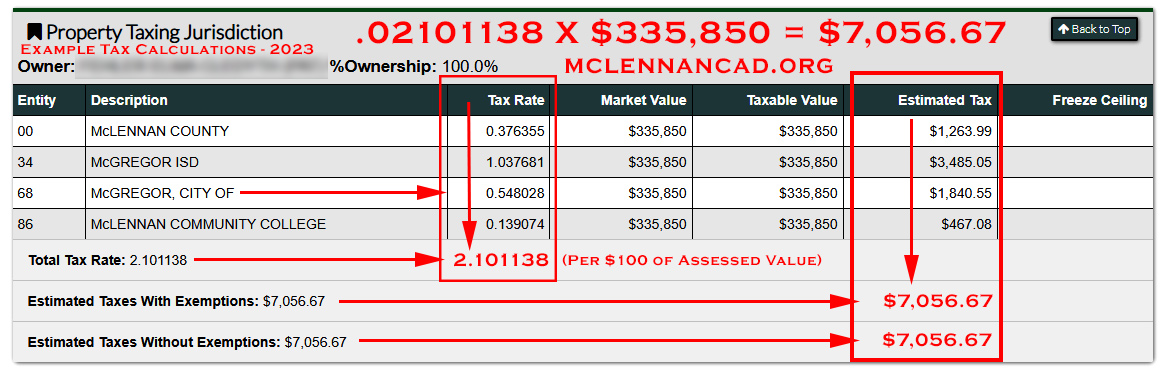

In McGregor, Texas

“people that own property” enjoy a TAX RATE of 2.101138 per $100 of Assessed

Value. Property owners pay this amount to 4 entities – McLennan County,

McGregor Independent School District, The City of McGregor, and McLennan

Community College.

The example below

was copied from the McLennan CAD website and is a genuine property in

McGregor. The added red graphic

demonstrates more clearly the rows and columns that are important to

understand.

The graphic below reports

the Total Tax Rate is 2.101138 [for McGregor], Texas. The example demonstrates if your property has a Taxable [Assessed]

Value of $335,850.00 then your Estimated Tax would be $7,056.67.

Imagine paying $588.00 per month “Just for Property Taxes “ on a fixed income.

Of course, there are a few TAX EXEMPTIONS – [if you qualify]. Rreference: https://comptroller.texas.gov/taxes/property-tax/exemptions — (Click on Property Tax Exemptions (PDF).

We need fixed-income people in charge of the tax assessment – not real estate professionals and/or bureaucrats. Make it your business to learn what is going on With Taxes in Texas and help us do something about it.

More Information – [My Google Drive] https://drive.google.com/drive/folders/1AM6uZINBFpK9MM_rERL4tF_u09enC0xi?usp=drive_link